Intelligent Process Automation (IPA) combines AI, machine learning, RPA, and analytics to automate end-to-end finance workflows and deliver faster, more accurate business outcomes. From AI invoice automation to AI-powered predictive analytics, IPA is enabling finance teams to reduce costs, tighten compliance, and produce strategic insights. This article outlines the highest-value IPA use cases, measurable impact, and proven best practices for enterprise deployment.

Why Finance Needs Intelligent Process Automation (IPA)

Modern finance functions face cost pressure, rising regulatory complexity, and customer expectations for instant, personalized service. IPA addresses these challenges by automating repetitive tasks, surfacing predictive insights, and embedding controls directly into workflows. Organizations that adopt IPA can shift finance from transaction processing to strategic advisory.

Core Use Cases of Intelligent Process Automation in Finance

AI Invoice Automation & Processing

Manual AP processing is slow and error-prone. AI invoice processing uses OCR, NLP, and rule engines to extract invoice data, match purchase orders, and route exceptions. Combined with AI-powered anomaly detection, systems can flag duplicates, unusual amounts, and suspicious vendors in real time.

Impact: 50–80% reduction in invoice handling time, fewer late payments, lower processing costs, and reduced fraud exposure.

Predictive Analytics for Forecasting & Planning

Predictive analytics with AI brings together historical transactions, market indicators, and seasonal patterns to produce accurate cash flow and revenue forecasts. Tools for AI-powered predictive analytics enable ‘what-if’ scenarios and automated reforecasting.

Impact: improved budget accuracy, proactive risk mitigation, and optimized working capital.

Fraud Detection & Anomaly Monitoring

Large transaction volumes make manual fraud detection ineffective. Applications of AI for anomaly detection continuously watch transaction streams and approval chains to detect outliers and suspicious behavior. Combining rules with unsupervised models reduces false positives while catching novel fraud patterns.

Impact: faster fraud detection, fewer financial losses, and stronger audit trails.

Generative AI for Compliance, Reporting & Documentation

Generating regulatory reports and audit documentation consumes valuable resources. Generative AI business use cases in finance include drafting compliance summaries, producing audit-ready narratives, and creating structured filings—leveraging GenAI capabilities to reduce manual effort while maintaining accuracy.

Impact: shorter reporting cycles, consistent documentation, and reduced compliance risk.

Accounts Reconciliation & Treasury Optimization

IPA accelerates reconciliation between bank statements, ledgers, and ERP systems using intelligent matching and AI-powered root cause analysis for exceptions. Predictive models help treasury teams forecast cash needs and optimize liquidity.

Impact: faster month-end close, improved cash visibility, and reduced borrowing costs.

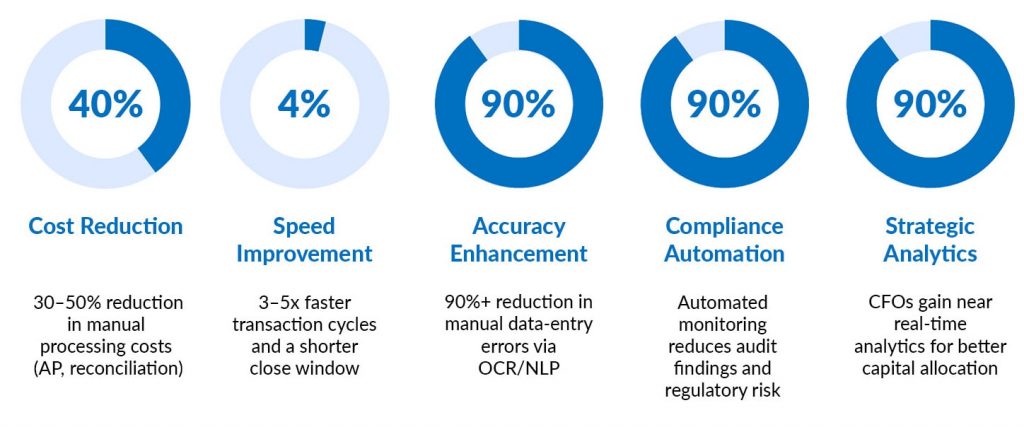

Business Impact & Metrics

When implemented correctly, IPA delivers measurable improvements across key finance KPIs:

Best Practices for Implementing IPA in Finance

- Start with High-Impact Pilots — Select 1–2 high-value processes (e.g., AP automation, fraud detection) to prove ROI quickly.

- Ensure Data Quality & Governance — Clean, well-governed data is essential for reliable predictive analytics.

- Choose Scalable, Interoperable Platforms — Evaluate enterprise solutions that integrate with ERP/CRM and cloud platforms to avoid vendor lock-in.

- Invest in Change Management & Skills — Offer targeted training and create internal champions.

- Monitor Continuously & Optimize — Track model drift, transaction anomalies, and KPI improvements regularly.

How Nsight Helps – Services & Next Steps

Nsight delivers end-to-end IPA implementations-strategy, data engineering, platform selection, and managed services. Start with a discovery to map high-impact use cases such as invoice automation and progress to enterprise-wide predictive analytics.

Conclusion

Intelligent Process Automation in finance is a strategic lever-beyond cost savings-to enable compliance, speed, and better decision-making. With careful case selection, strong data governance, and continuous monitoring, organizations can unlock significant, measurable value.

Process Automation insights guide.

About the Author

Deepak Agarwal, a digital and AI transformation expert with over 16 years of experience, is dedicated to assisting clients from various industries in realizing their business goals through digital innovation. He has a deep understanding of the unique challenges and opportunities, and he is passionate about using cutting-edge technologies to solve real-world business problems. He has a proven track record of success in helping clients improve operations, increase efficiency, and reduce costs through emerging technologies.